The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 (‘the Act’) has introduced mandatory climate-related disclosures for most entities reporting under Chapter 2M of the Corporations Act 2001.

Key requirements

- Affected entities: Only those entities required to prepare annual financial reports under Chapter 2M of the Corporations Act 2001 and satisfying prescribed size thresholds. A Sustainability Report is not required in an affected entity’s half-year financial report.

- Start date: Phased implementation commencing for financial years beginning on or after 1 January 2025.

- Reporting basis: As required by Australian Sustainability Reporting Standards (ASRS).

- Disclosure of scenario analyses: The Act mandates the disclosure of scenario analyses required by ASRS based on at least the following two climate scenarios:

i. an increase in the global average temperature of 1.5°C (a low global warming scenario referenced in the Climate Change Act 2022); and

ii. an increase in the global average temperature of at least 2.5°C above pre‑industrial levels (being an increase that ‘well exceeds’ the high global warming scenario of 2.0°C referenced in the Climate Change Act 2022).

- Directors’ declaration on sustainability reports: The directors declare whether, in the directors’ opinion, the substantive provisions of the Sustainability Report are in accordance with the Corporations Act. The substantive provisions of a Sustainability Report relate to the requirements of ASRS.

- Reporting deadlines: A sustainability report forms part of an entity’s annual report and is subject to the same relevant annual financial reporting timetable.

- Assurance requirements: A phased assurance approach for financial years commencing on or before 30 June 2030. For financial years commencing on or after 1 July 2030, the Sustainability Report is required to be audited. In addition, the Act requires the auditor to form an opinion as to whether the entity has kept sustainability records sufficient to enable the Sustainability Report to be prepared and audited.

- Transition: The following transitional provisions apply in addition to the phased implementation of mandatory climate disclosures:

• A modified form of the directors’ declaration applies to the entity’s first three Sustainability Reports, whereby the directors declare whether ‘the entity has taken reasonable steps to ensure the substantive provisions of the sustainability report are in accordance with’ the Corporations Act.

• Up to three-year modified liability approach to disclosures of Scope 3 emissions and climate-related forward-looking statements. Modified liability is also extended to statements made in the auditor’s report.

Affected entities and phasing

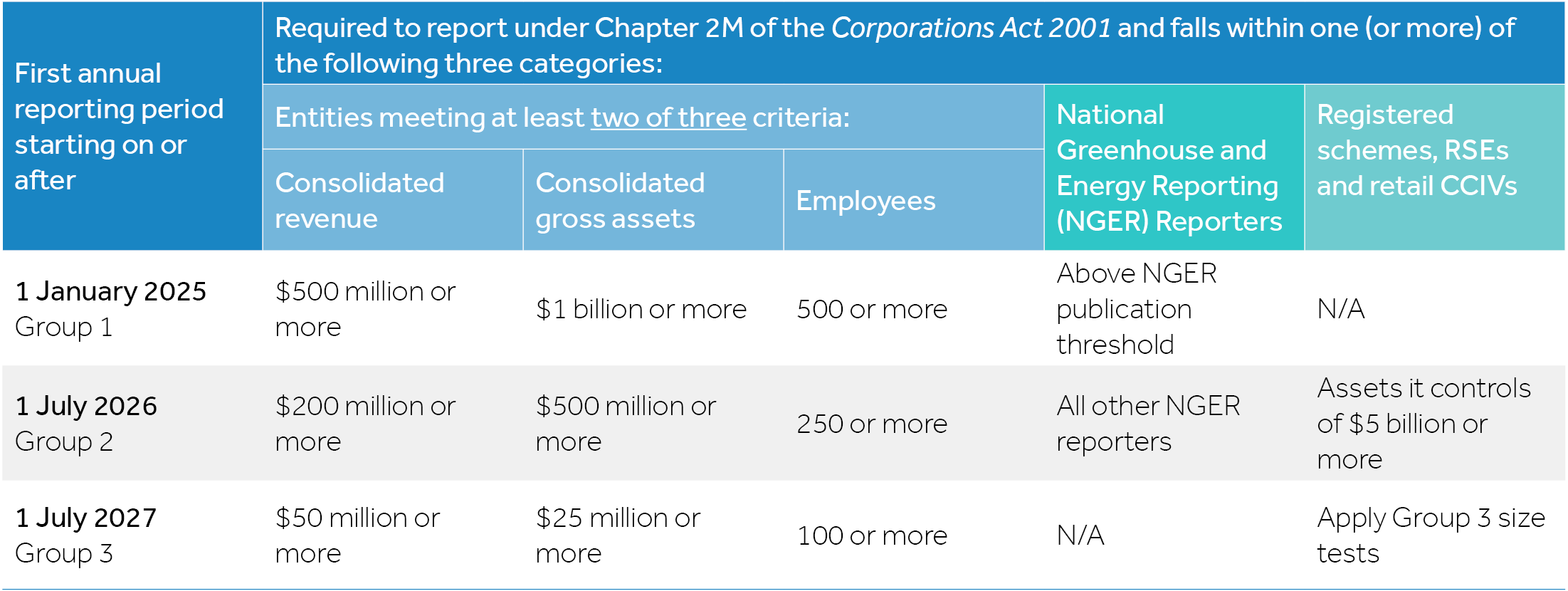

Three categories of entities will be subject to mandatory climate-related reporting. These are entities that are required to prepare an annual report under Chapter 2M of the Corporations Act, and either:

- Meet at least two of three size thresholds relating to consolidated revenue, consolidated assets, and employees; or

- Are subject to emissions reporting obligations under the National Greenhouse and Energy Reporting Act 2007 (NGER Act), regardless of size; or

- Are registrable superannuation entities (RSE), registered schemes, and retail CCIVs over specified size thresholds.

Reporting of climate-related information is required on the following phased basis:

Large proprietary companies will be required to report climate-related information from no later than 1 July 2027 (i.e., 30 June 2028 or 31 December 2028 year ends).

Entities below the relevant sustainability reporting thresholds and those that are exempt from preparing financial reports under Chapter 2M of the Corporations Act, including where exemptions apply under ASIC legislative instruments or where the entity is registered with the Australian Charities and Not-for-profits Commission, will not be required to make climate-related financial disclosures.

A large company limited by guarantee with annual (consolidated) revenue of $1 million or more required by the Corporations Act to prepare an annual financial report is only required to include climate-related information if it also meets any of the other sustainability reporting thresholds above.

Consolidated entities

The sustainability reporting requirements apply to each entity that satisfies the above sustainability reporting criteria. However, if a parent entity is required by accounting standards to prepare consolidated financial statements, it may choose to prepare its Sustainability Report also on a consolidated basis. In this case, each other group entity need not prepare a Sustainability Report does not need to prepare a Sustainability Report, provided the consolidated Sustainability Report covers those individual entities.

Reporting requirements

A company’s annual report will now comprise four separate reports:

- A Director’s Report;

- The Financial Report, comprising the financial statements and notes prepared in accordance with Australian Accounting Standards, and a directors’ declaration on those statements and notes;

- A Sustainability Report; and

- Auditor’s reports.

The Sustainability report comprises:

i. the ‘climate statements’ and notes to the climate statements;

ii. any other statements relating to financial matters concerning environmental sustainability required by legislative instruments; and

iii. a directors’ declaration on those statements and notes.

‘Climate statements’ are those statements required by ASRS issued by the Australian Accounting Standards Board. ASRS will initially comprise two2 standards:

- AASB S1 General Requirements for Sustainability-related Financial Information, a voluntary standard that will be equivalent to IFRS S1 General Requirements for Sustainability-related Financial Information; and

- AASB S2 Climate-related Disclosures, a mandatory standard that will be aligned to IFRS S2 Climate-related Disclosures with modifications to eliminate references to industry-based disclosure topics in the SASB Standards and Industry-based Guidance on Implementing IFRS S2 and will not mandate the disclosure of industry-based metrics.

Not-for-profit entities reporting under Chapter 2M of the Corporations Act 2001 and meeting the sustainability reporting thresholds will be required to prepare a Sustainability Report and apply AASB S2.

Other than for an entity’s first sustainability reporting period, a Sustainability Report must include comparative information.

Directors’ declaration on the Sustainability Report

A directors’ declaration is required on the Sustainability Report that declares whether, in the directors’ opinion, the substantive provisions of its Sustainability Report are in accordance with the Corporations Act.

Limited exemption for Group 3 entities

Group 3 entities will be required to make climate-related financial disclosures if they face material climate-related financial risks or financial opportunities during the financial reporting period. Materiality will be assessed in accordance with ASRS and will not necessarily represent financial statement materiality.

Where a Group 3 entity assesses that it does not have material climate-related financial risks and financial opportunities, it is still required to include a Sustainability Report that includes a statement to that effect. That Sustainability Report would include any disclosures that may be required by future legislative instruments but would not otherwise have to:

i) comply with ASRS;

ii) report its greenhouse gas emissions;

iii) report information about its governance, strategy, and risk management in relation to climate-related risks and opportunities; or

iv) disclose any metrics and targets.

The entity would still include a directors’ declaration confirming that it does not have material climate-related financial risks and financial opportunities and have the statement audited.

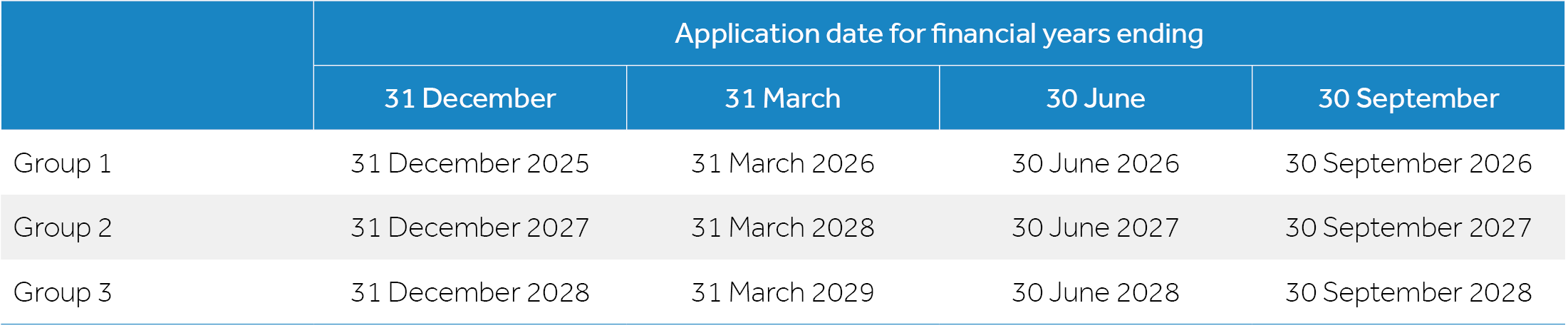

Sustainability reporting dates

Because a Sustainability Report forms part of an entity’s annual report, the timing of lodgement of the Sustainability Report with ASIC and reporting to members will follow the current annual financial reporting timing requirements.

Under section 319 of the Corporations Act, disclosing entities and registered managed investment schemes are required to lodge their financial report with ASIC within three3 months after the end of the financial year, and all other companies within four4 months after the end of the financial year.

The Sustainability Report must be sent to members and, where relevant, considered at an entity’s Annual General Meeting, in accordance with the relevant timing requirements for the annual report.

Assurance requirements

Climate disclosures will be subject to similar assurance requirements to those currently applicable in the Corporations Act for financial reports and will require entities to obtain an assurance report from their financial statements auditor.

The Australian Auditing and Assurance Standards Board is developing a pathway for phasing in assurance requirements over time and is expected to issue a final assurance standard before December 2024.

Auditor independence requirements are expected to apply equally to a company’s financial report and Sustainability Report.

Liability framework

Climate disclosures will be subject to the existing liability framework under the Corporations Act and Australian Securities and Investments Commission Act 2001 including: director’s duties, misleading and deceptive conduct provisions, and general disclosure obligations. This is designed to ensure directors engage fully with their climate disclosure obligations.

However, limited immunity from liability will apply for company directors and auditors for a three-year period commencing from the start date of the legislation for disclosures relating to Scope 3 emissions, scenario analysis and transition plans. This means that Group 3 entities are unlikely to benefit from this relief.

Limited immunity would also apply to forward-looking statements made in relation to climate but only for the first 12 months commencing from the start date of the legislation. Effectively, this relief will only apply to Group 1 entities.

The nature of the limited immunity means that the regulator will still be able to take action relating to misleading and deceptive conduct in relation to protected statements, but no other legal action is able to be brought against a person or entity.

Beyond the limited immunity period, the existing liability framework under the Corporations Act and Australian Securities and Investments Commission Act will apply.

Transition

In addition to the limited relief to the directors’ liability framework referred to above, a modified form of the directors’ declaration on the climate statements applies for the first three years. The modified directors’ declaration states that ‘the entity has taken reasonable steps to ensure the substantive provisions of the Sustainability Report are in accordance with’ the Corporations Act.

A company will not be required to disclose comparative information in its first annual reporting period.

Post implementation review

The Act requires the government to conduct a review of these laws as soon as practicable after 1 July 2028.

Next steps

With the passage of the legislation, affected companies need to start planning for the implementation of these substantial new climate reporting requirements.

Talk to your trusted Nexia advisor if you have any questions about the matters discussed in this article.